Published on November 18, 2015

Not only start-ups but also early stage investors should adopt the lean start-up paradigm. Todays practice; investors take weeks for letting external due diligence teams re-calculate prognoses and stipulate every imperfection in all legal documents. Instead, we at Newion feel, they must start with challenging the founders on their lean canvas hypothesis, learn from their ‘customer interaction’ and try to answer questions like: what market data points are gathered?, have they pivoted yet?

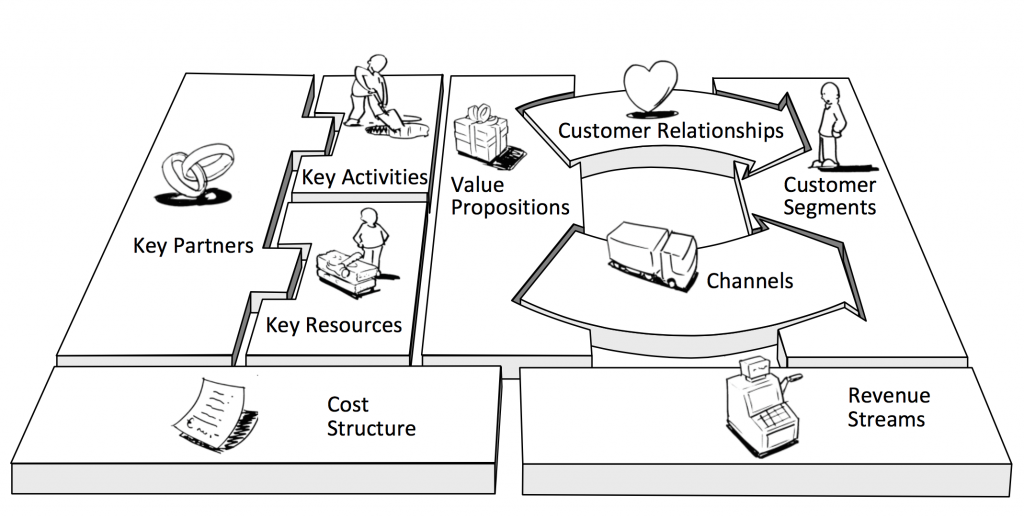

If it turns out the business model isn’t validated, or put it in another way: the lean canvas isn’t completely found yet, they need to be willing to assist the team to make a plan to complete this validation and see if they can fund this plan, or to put it in other words, provide them a sufficient runway.

Let’s go back to the basics of Eric Ries’s philosophy; premature scaling is the cause of failure, before scaling the hypothesis of the lean canvas has to be proven.

Since Eric Ries introduced in 2008 his philosophy, the Lean Start-up, for developing businesses and products a tsunami of publications and workshops have been posted and/or have been organised based on this vision.

Ries claims that start-ups can shorten their product development cycles by adopting a combination of business-hypothesis-driven experimentation and iterative product releases by investing their time into iteratively building products to meet the needs of early customers. As a result of this, start-ups reduce market risk and, perhaps even more relevant, the need for large amounts of funding for financing expensive product launches and failures. Today, the lean start-up’s popularity has outgrown Silicon Valley, it’s birthplace, and is spread out all over the world. Why should early stage investors in scalable start-ups fully adopt the Lean Start-up philosophy?

In his blog May ’14 John Richards, panel member of FundersClub, already spoke out his surprise that investors have not upgraded their knowledge yet in order to keep pace with the massive Lean Start-up shift. Luckily, I feel some early stage VC’s already changed their investment practise in this direction.

The amount of money needed for validating the lean canvas hypothesis is, to my opinion within European B2B software domain, limited to EUR 1.5M — EUR 2M, so why negotiating on series A rounds of millions of Euros?

If the business model is validated you can start proof scaling. This demands a transformation of the start-up. This transformation needs to be planned. Based on the ambition, vision and mission the start-up has to build a plan in order to successfully pass this stage and to prepare for its scaling stage. Basically the funding needs to buy the start-up time to enable it to grow into this stage.

Changing habits takes time, but from my own experience I am happy to state: “if we at Newion can do it; every early stage investor can”!